International trade sounds like a straightforward process but the reality is a maze of rules, paperwork, and surprise obstacles at every turn. Customs import brokers manage thousands of complex shipments every day and are required to complete 36 hours of continuing education every three years to keep up with shifting regulations. Most people think these brokers just handle documents and fees but their real superpower is guiding businesses past massive legal and financial risks that most companies never even see coming.

Table of Contents

- What Is A Customs Import Broker And What Do They Do?

- The Importance Of Customs Import Brokers In Trade

- How Customs Import Brokers Navigate Regulations And Compliance

- Key Concepts And Terminology In Customs Brokerage

- The Future Of Customs Import Brokerage And Trade Practices

Quick Summary

| Takeaway | Explanation |

|---|---|

| Customs brokers ensure compliance | They facilitate adherence to regulations, avoiding legal issues and costly penalties. |

| Continuous education is essential | Brokers must complete 36 hours of education every three years to adapt to changing trade laws. |

| Risk mitigation is a primary function | Brokers identify compliance issues before shipments, preventing potential customs violations. |

| Brokers optimize import processes | They help businesses reduce delays and costs through efficient import strategies. |

| Technology is transforming customs brokerage | Advanced tools enhance documentation handling and compliance management in trade practices. |

What is a Customs Import Broker and What Do They Do?

A customs import broker is a specialized professional who serves as a critical intermediary between businesses engaged in international trade and government customs agencies. These licensed professionals facilitate the complex process of importing goods across international borders, ensuring that shipments comply with all relevant regulations, tariffs, and legal requirements.

Key Responsibilities of a Customs Import Broker

Customs import brokers perform a multifaceted role that goes far beyond simple paperwork processing. Their core responsibilities include:

- Preparing and submitting accurate customs documentation

- Calculating and managing import duties and taxes

- Interpreting complex international trade regulations

- Ensuring regulatory compliance for imported goods

- Advising clients on import procedures and potential challenges

These professionals must possess an intricate understanding of international trade laws, tariff classifications, and government import regulations. They work diligently to help businesses navigate the often complicated landscape of cross border shipping and trade compliance.

To help clarify the primary services and key value delivered by customs import brokers, the following table outlines their main responsibilities and the benefits provided to importing businesses.

| Responsibility | Description | Value to Business |

|---|---|---|

| Customs Documentation | Prepares and submits paperwork for imported goods | Ensures timely, compliant importation |

| Duty and Tax Management | Calculates and manages applicable duties and taxes | Reduces risk of financial penalties |

| Regulatory Compliance | Interprets and applies international trade regulations | Avoids legal issues and import delays |

| Product Classification | Classifies goods accurately based on tariffs | Minimizes risk of misclassification fines |

| Client Advising | Offers guidance on import challenges and procedures | Improves importing strategy and compliance |

| Continuous Education | Maintains up-to-date knowledge on evolving regulations | Provides current, relevant trade expertise |

Licensing and Professional Requirements

According to U.S. Customs and Border Protection, customs import brokers must obtain a valid license through a rigorous certification process. As of June 2023, individual brokers are now required to complete 36 hours of continuing education every three years to maintain their professional credentials. This ensures that brokers stay current with evolving trade regulations and can provide the most up-to-date guidance for their clients.

Businesses rely on customs import brokers to streamline their international trade operations, reduce potential legal risks, and minimize financial penalties associated with improper import procedures. For companies looking to understand more about logistics professionals, read our detailed guide on broker roles.

The Importance of Customs Import Brokers in Trade

Customs import brokers play a pivotal role in the global trade ecosystem, serving as essential gatekeepers who ensure smooth, compliant, and efficient international commerce. Their expertise transforms complex regulatory challenges into manageable business processes, enabling companies to navigate the intricate landscape of cross-border trade with confidence and precision.

Risk Mitigation and Compliance Management

In an increasingly complex global trade environment, customs import brokers are crucial for managing potential risks and ensuring regulatory compliance. Their comprehensive understanding of international trade regulations helps businesses avoid costly penalties and legal complications. Key risk management strategies include:

- Identifying potential compliance issues before shipments occur

- Verifying accurate product classification and valuation

- Ensuring adherence to international trade agreements

- Monitoring changing customs regulations and requirements

- Preventing potential customs violations

According to the U.S. International Trade Commission, these professionals are critical in facilitating legitimate trade while protecting national economic interests by preventing unauthorized or non-compliant imports.

Financial and Operational Efficiency

Beyond regulatory compliance, customs import brokers deliver significant financial and operational benefits to businesses. They help companies optimize their import processes, reducing delays and minimizing unnecessary expenses. By leveraging their expertise in tariff classifications, duty calculations, and import regulations, brokers can help businesses identify cost-saving opportunities and streamline their international trade operations.

For businesses seeking deeper insights into logistics and trade management, explore our comprehensive guide on trade logistics to understand how professional brokers can transform your international trade strategy.

How Customs Import Brokers Navigate Regulations and Compliance

Customs import brokers function as sophisticated regulatory navigators, translating complex international trade rules into actionable strategies for businesses. Their expertise goes beyond simple documentation, encompassing a comprehensive approach to understanding and implementing intricate compliance frameworks across multiple regulatory environments.

Regulatory Intelligence and Monitoring

Successful customs import brokers maintain an extensive, proactive approach to regulatory management. They continuously track changes in international trade policies, tariff structures, and government regulations to ensure their clients remain fully compliant. This requires a dynamic skill set that includes:

- Monitoring global trade policy updates

- Analyzing potential regulatory impacts on specific industries

- Tracking changes in international trade agreements

- Interpreting new customs regulations and requirements

- Developing adaptive compliance strategies

According to U.S. Customs and Border Protection, brokers are licensed professionals who must demonstrate comprehensive knowledge of federal import requirements and constantly evolving trade regulations.

Comprehensive Compliance Management

Effective compliance management involves more than understanding rules it requires anticipating potential challenges. Customs import brokers develop sophisticated strategies that protect businesses from potential legal and financial risks. They meticulously review documentation, verify product classifications, and ensure all import processes align with current regulatory standards.

For businesses seeking to enhance their understanding of international trade logistics, explore our comprehensive logistics guide to gain deeper insights into navigating complex regulatory landscapes.

Key Concepts and Terminology in Customs Brokerage

Customs brokerage involves a complex ecosystem of specialized terminology and intricate regulatory frameworks that professionals must master to facilitate international trade effectively. Understanding these key concepts enables businesses to navigate the sophisticated landscape of global commerce with precision and confidence.

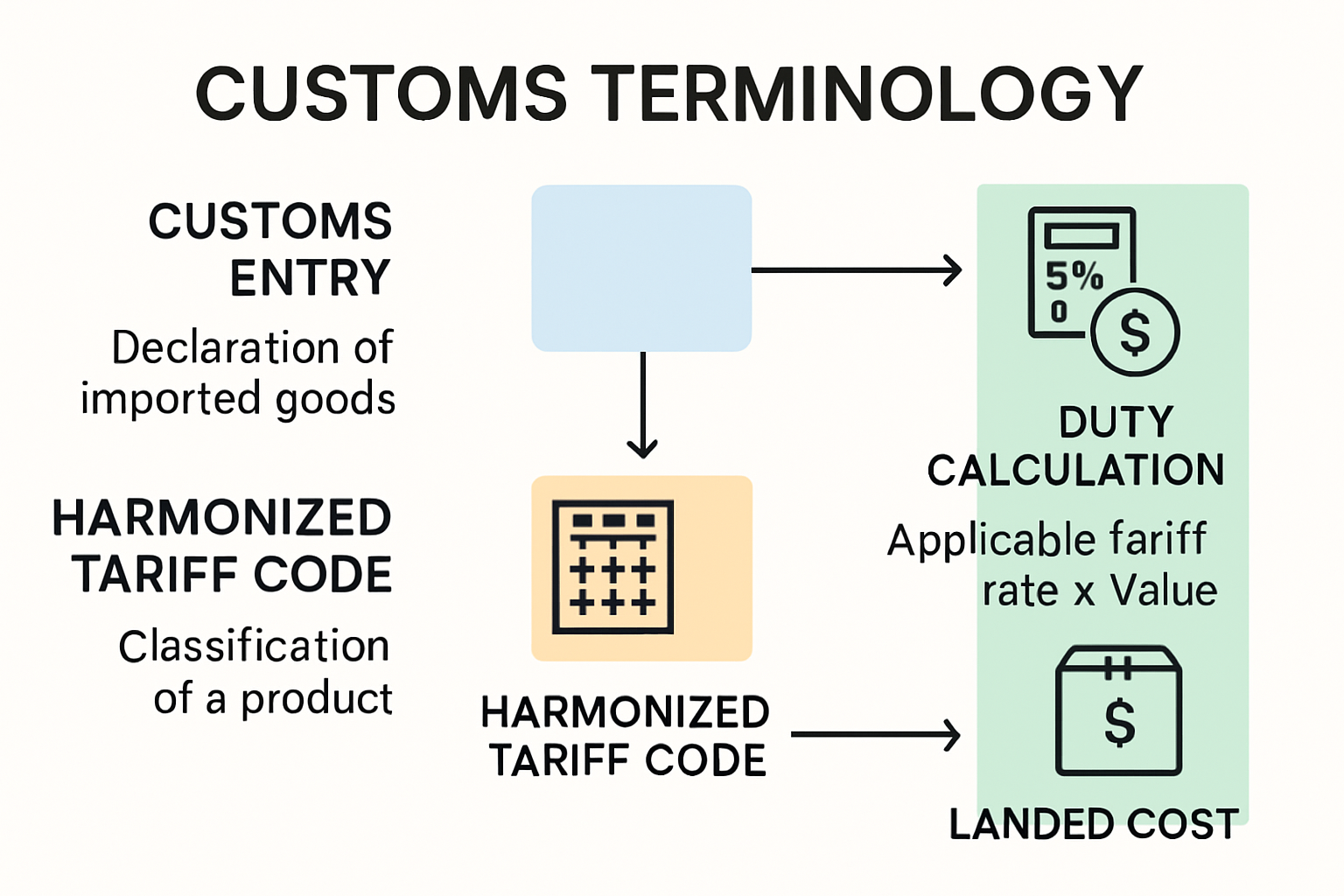

Essential Import and Classification Terminology

Customs brokers work with a range of specialized terms that are critical to understanding international trade processes. These fundamental concepts help importers and brokers communicate effectively and ensure compliance with international regulations. Key terminology includes:

- Harmonized Tariff Schedule (HTS): A comprehensive classification system for assigning duty rates and tracking international trade statistics

- Customs Entry: Official documentation declaring imported goods to government authorities

- Landed Cost: Total expense of a product after accounting for shipping, duties, taxes, and other associated fees

- Duty Drawback: A refund of customs duties paid on imported merchandise that is subsequently exported

- Valuation: The process of determining the appropriate monetary value of imported goods for taxation purposes

According to the International Federation of Customs Brokers Associations, these technical terms form the foundation of effective international trade management.

For readers seeking clarity on specialized terms used in the world of customs brokerage, this table provides straightforward definitions of the most commonly referenced concepts in the article.

| Term | Definition |

|---|---|

| Harmonized Tariff Schedule | System for classifying goods and assigning duty rates for international trade |

| Customs Entry | Official document declaring imported goods to authorities |

| Landed Cost | Total cost of a product including shipping, duties, taxes, and fees |

| Duty Drawback | Refund of duties paid on imported goods that are later exported |

| Valuation | Determining the proper value of imported goods for taxation |

Regulatory Classification and Compliance Framework

Precise classification is the cornerstone of successful customs brokerage. Brokers must understand complex systems like the Harmonized System (HS), which provides a standardized numerical method for categorizing traded products. This system allows governments to apply appropriate tariffs, track statistical data, and enforce trade policies consistently.

For professionals seeking deeper insights into international logistics terminology, explore our comprehensive logistics guide to enhance your understanding of trade management complexities.

The Future of Customs Import Brokerage and Trade Practices

The customs import brokerage landscape is undergoing a transformative evolution, driven by technological advancements, shifting global trade dynamics, and increasingly complex regulatory environments. Professionals in this field must adapt to emerging trends that are fundamentally reshaping international trade processes and compliance strategies.

Digital Transformation and Technological Integration

Customs brokerage is experiencing a profound digital revolution that is fundamentally changing how trade compliance and documentation are managed. Modern brokers are leveraging cutting-edge technologies to streamline operations and enhance efficiency. Key technological developments include:

- Artificial intelligence for automated documentation processing

- Blockchain technologies for enhanced supply chain transparency

- Advanced data analytics for predictive compliance management

- Cloud-based platforms for real-time international trade monitoring

- Machine learning algorithms for complex regulatory interpretation

According to U.S. Customs and Border Protection, these technological integrations are critical for modernizing trade processes and enabling secure, real-time data exchange between government agencies and trade entities.

Sustainability and Regulatory Evolution

The future of customs brokerage is increasingly intertwined with global sustainability goals. Emerging regulatory frameworks are placing greater emphasis on environmental considerations, requiring brokers to develop sophisticated strategies that balance economic efficiency with ecological responsibility. This shift demands a more holistic approach to international trade that considers carbon footprints, sustainable supply chains, and environmentally conscious trade practices.

For professionals seeking to stay ahead of these transformative trends, explore our comprehensive logistics guide to understand the evolving landscape of international trade management.

Ready to Simplify Customs Import Challenges?

Navigating import regulations and compliance can feel overwhelming. The article highlighted the stress and risk that come with misclassifying goods, missing critical documentation, or incurring unexpected fees. Your business needs more than advice—you want predictable, seamless clearance every time, freeing you to focus on growth instead of red tape.

At Worldwide Express, Inc., our team of licensed customs brokers brings hands-on expertise in customs entry, product classification, duty calculation, and complex compliance. We offer tailored solutions designed for businesses like yours. Trust our comprehensive logistics services to ensure every shipment moves smoothly, no matter how complicated the rules become. Do not let customs headaches stall your business. Visit our main site to connect with a specialist today and unlock faster, safer global shipping now.

Frequently Asked Questions

What is the main role of a customs import broker?

A customs import broker serves as an intermediary between businesses and government customs agencies, facilitating the importation of goods and ensuring compliance with international trade regulations.

How do customs import brokers help with compliance management?

Customs import brokers manage compliance by interpreting trade regulations, preparing necessary documentation, and advising businesses on regulatory requirements, thereby minimizing legal risks and penalties.

What qualifications are required to become a customs import broker?

To become a customs import broker, individuals must obtain a valid license through U.S. Customs and Border Protection and complete ongoing education requirements every three years to maintain their credentials.

How do customs import brokers optimize the importing process for businesses?

Brokers help businesses save time and money by streamlining import processes, calculating duties accurately, and identifying cost-saving opportunities, which enhances overall operational efficiency.